Judging from recent developments, cryptocurrencies will eclipse traditional currencies in the coming years. This is due to the convenience that these digital currencies offer users. To make transactions involving cryptocurrencies, you need a cryptocurrency wallet.

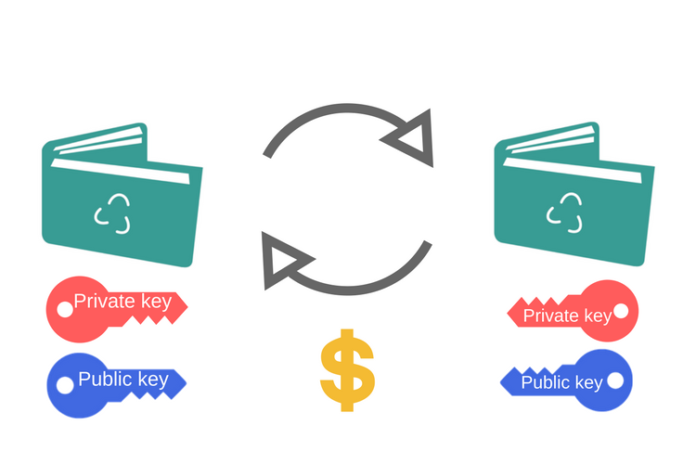

Cryptocurrency wallets are software programs that store both public and private keys while interacting with multiple blockchains. This allows you to receive and send cryptocurrencies as well as check your balance. Typically, cryptocurrency wallets consist of at least a single set of public and private keys.

How Cryptocurrency Wallets Work

Unlike traditional wallets, which you can keep in your pocket, cryptocurrency wallets aren’t stored in a single location. Moreover, they do not exist in any physical form. These are just software programs that store records of cryptocurrency transactions on a blockchain.

The software stores users’ private and public keys as well as their interfaces on blockchains. This allows them to send and receive crypto cash, monitor their balances, and also undertake other transactions. If another user sends you a cryptocurrency, it means that he/she is transferring those coins to your address.

You can only unlock the funds and spend those coins if the private and public keys are similar. Similarly, your crypto cash balance will increase since the sender will have signed off a specific amount to your wallet address.

Major cryptocurrencies such as Bitcoin come with an online exchange, which allows users to sign up and create web wallets. One of the major issues that users have to take in stride is the fact that they can’t control their private keys. Essentially, it means that the security of their private keys and wallet is in the hands of a third-party operator.

Types of Crypto Wallets

Online Wallets

Just like the name suggests, online cryptocurrency wallets run on the cloud. They also store users’ private keys on the cloud. Therefore, users can access them from any location using a computing device. In as much as online cryptocurrency wallets offer you quick and convenient access to your digital cash, they are vulnerable to hacking incidents that may result in the loss of your crypto cash.

Mobile Wallets

A mobile cryptocurrency wallet runs on an app that gets installed on your phone. This offers you the convenience of accessing your crypto cash from anywhere. These wallets are more straightforward and smaller than desktop wallets due to the limited space that is available on mobile devices.

Figure 2: Bitcoin Wallet Mobile App

Desktop Wallets

These cryptocurrency wallets typically get downloaded and installed on laptops or PCs. You will only be able to access your wallet from the PC on which it got downloaded. This way, security is guaranteed. Nonetheless, desktop wallets can be inconvenient since they may not offer you the flexibility of accessing your cash while on the go. Similarly, you risk losing your cash if your computer gets hacked.

Hardware Wallets

When using hardware wallets, your private keys will be stored on hardware devices such as USB disks. Even though you will make transactions online, hardware wallets are stored offline.

Figure 3: Trezor, a Popular Hardware Wallet

Conclusion

There are dozens of cryptocurrency wallets that you can use to store your digital cash. When choosing a cryptocurrency wallet, you should consider the functionality, reliability, and performance of wallets under consideration. Similarly, only pick wallets that allow you to use multiple currencies.