Bitcoin mining has hit an all-time high, becoming more competitive. According to Blockchain.com, this difficulty is apparent in the level of competition for block rewards among miners.

Mining Becoming More Competitive

Bitcoin mining difficulty, which measures how hard it is to earn rewards while mining Bitcoin, has hit a record high of over 7.93 trillion. This is a 7% increase in the record set during the adjustment cycle, which was 7.45 trillion.

The Bitcoin network has been developed to automatically adjust the level of difficulty after every 2,016 blocks which are solved in approximately 14 days, depending on the computing power used in the network. When more computers are solving the math problems difficulty increases while fewer computer sees the level of difficulty fall.

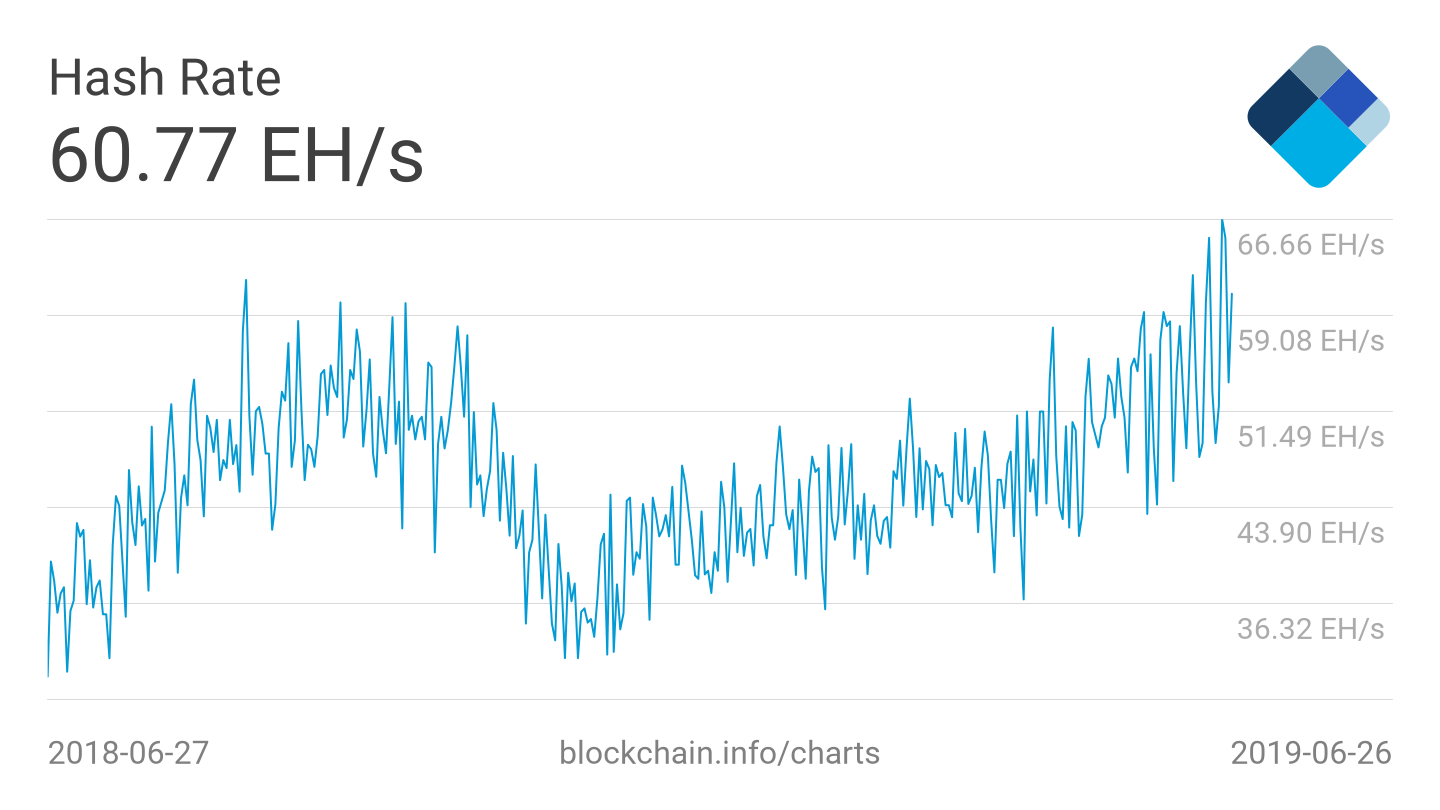

Going by data provided by BTC.com, in the last fourteen days miners across the world have been calculating at a rate of 56.77 quintillion hashes/second (EH/s). The average hash rate of three days period has been recorded as 59.70 EH/s which has surpassed the previous record of 56.77 EH/s. Additionally, data from blockchain.info, the Bitcoin computing power aggregate, hit 66 EH/s as of the 22nd of June, which is higher than the 61.86 EH/s record set in 2018.

In other words, what this data shows is that the level of competition among miners, as well as the general security of the Bitcoin network, has hit an all-time high level never witnessed before.

Mining Difficulty Expected To Go Up In The Next Adjustment Cycle

Metrics such as these reflecting on the bitcoin network boosts the confidence of analysts and the Crypto market as a whole. This is because they show that there is continuous growth in the network. The bull run so far experienced in the market is due to the stability of the network, following the long bear market experienced in the last quarter of 2018. At the lowest point last year, the network saw a 32 quintillion hash rate. At the highest point, in August, the hash rate cycled at 61 quintillions.

This increase in the network’s capacity is comparative to the Cryptocurrency’s jump in prices experienced in the first half of the year. This period saw the demand for second-hand mining equipment in China more than double while the demand for new machines also increased. BTC.com estimates that the mining difficulty will increase by another 7% in the next adjustment cycle. Should this happen, it will be the first time the digital currency’s mining difficulty has gone past the eight trillion threshold.

The next Bitcoin reward halving which will be taking place in May 2020 is expected to have a major impact on the sentiments of Bitcoin miners and adjust the prices accordingly.

Halving Responsible For The Increased Capacity

According to a research published by Pantera Capital, a Crypto hedge fund, the halving event may be responsible for the prices of the Cryptocurrency going up a year in advance. The research published earlier in the year stated that these increases took place for 376 and 320 days before the scheduled 2012 and 2016 halvings, respectively.