With cryptocurrencies making headlines each day despite their plummeting market prices, more and more people are acquiring digital currencies. And they are doing so through exchange platforms.

Both retail of the institutional investors have an end goal of achieving a maximum return to their investment. It’s pragmatic for a professional trader to invest in an exchange which requires an exhaustive KYC process with legit adverse media and invulnerable security protocols.

Centralized Exchanges Vs Decentralized Exchanges

The whole idea behind Blockchain technology is decentralization where the initiative is open sourced and power is distributed instead of being concentrated on a central authority. However, there is an exception.

Centralized exchanges directly disobey Blockchain values since the assets are controlled by a single and central entity. The entity possesses all the keys and is in access to all your funds and assets. A small technical breakdown and all your funds disappear. This raises some serious trust issues.

Centralized exchange platforms like Coinbase, Binance, Kraken, Bitfinex all share a larger market share. But some of the platforms like the Binance Company is realizing the need for decentralization and is working to launch a decentralized platform.

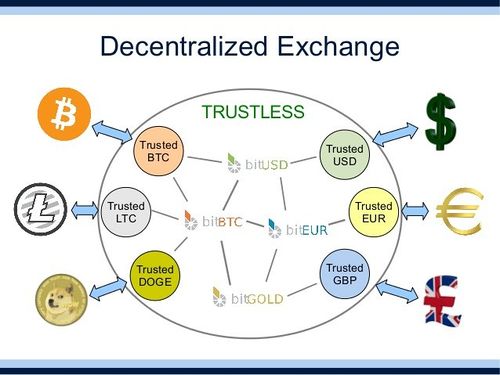

On the other hand are decentralized exchanges like the Radar Relay, Bisq, IDEX, Openledger DEX, etc which operate on a peer to peer protocol just like Blockchain. What this means is that the system runs on a number of independent nodes and this ensure functionality even after a single point failure.

One major difference between the two platforms is liquidity. Decentralized platforms don’t have enough market makers like their centralized counterparts. Market makers attract takers which is why liquidity is not enough for the decentralized platforms to compete with the centralized platforms.

Choosing An Exchange

Cryptocurrencies operate on a 24/7 basis, unlike the NYSE and other stock exchange which operate in specific time zones. This is one of the reasons for their volatility.

Now, knowing enough about a digital currency does not suffice good returns. It’s important to know the ins and out of the exchange you would be using.

There is no similarity between crypto investing and investing in banks, traditional exchanges and credit unions. In crypto exchanges, there are no fail safes to protect your investment. A small mistake can be devastating.

Unlike traditional investments and exchanges, there is no hotline to call when stuck nor a corporate headquarter to reach when you lose out your funds. There is not even backing from an FDIC insured bank on the investment. That brings us to the credibility issue.

Ways To Define Credibility Of An Exchange;

Good enough security measures that can withstand attempts by hackers. Extensive measures like the 2-way verification, captcha measures, and password strengths are crucial as well.

For institutional grade investors, it’s crucial to research and have data for each exchange platform at hand and to pick one that meets the investment criteria. If the trading volumes of exchange are high, the exchange is probably genuine.

The location of the exchange can be a red flag as well. If you can’t pinpoint its location, it will be tough finding the people to sue to in case things go south.

Often, transactions that are more secure charge higher.